property tax assistance program montana

Flathead County Treasurer290 A North MainKalispell MT 59901. PTAP provides this assistance to these.

What Is A Homestead Exemption And How Does It Work Lendingtree

Check If You Qualify For This Homeowner StimuIus Fast Easy.

. Utility Payment Assistance. Check If You Qualify For 3708 StimuIus Check. You have to meet income and property ownershipoccupancy requirements every year.

Property Tax Relief If you are low income a 100 disabled veteran or surviving spouse or had a large increase in your property taxes due to reappraisal you may qualify for tax assistance. Did you file a Montana income tax return for tax year 2017. 21032 or less for a single person or 28043 or less for a married couple.

Latest version of the adopted rule presented in Administrative Rules of Montana ARM. Check Your Eligibility Today. 4219401 - PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM.

The Property Tax Assistance Program PTAP was created for property owners who need help paying off their taxes which can be quite high considering the amount of land that you can purchase in Montana. Please call us at 406 444-6900 or Montana Relay at 711 for hearing impaired or visit our website at revenuemtgov. A new Montana property tax assistance program is designed to help residential property owners whose land value is disproportionately higher than the value of their home.

The reduction depends on. Helena The Montana Department of Revenue wants to let property owners know about a change in state property tax assistance programs to make it easier for taxpayers to apply for reduced property taxes. 2 The first 200000 in appraisal value of residential real property.

Montana Disabled Veteran Assistance Program MVD. Property Tax Assistance Program PTAP Application for Tax Year 2018. Check Your Eligibility Today.

F orm PPB-8 Property Tax Assistance. Assistance programs affect the property tax bill. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

Maximum of 5000 in the form of a grant to prevent property tax foreclosure or remove or prevent creation of other liens HOA COA CLT lease payments etc that would place homeowner at imminent risk of displacement. You may use this form to apply for the Property Tax Assistance Program PTAP. Property Tax bills are mailed in October of each year to the owner of record as their name and mailing address appear on the tax roll.

Property tax assistance program -- fixed or limited income. Mortgage Relief Program is Giving 3708 Back to Homeowners. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of assisting citizens with limited or fixed incomes.

Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax rates on their homes. 4 The property tax exemption under this section remains in effect as long as the qualifying income requirements are met and the property is the primary residence owned and occupied by the veteran or if the veteran is deceased by the veterans spouse and the spouse. A is the owner and occupant of.

The tax roll is prepared and maintained by the State of Montana Department of Revenue. Tax forms available from Department of Revenue. Property owners who already benefit from the Property Tax Assistance Program PTAP or Montana Disabled Veteran MDV program do not have to.

Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. Maximum of 300 per month in the form of a grant to pay. The home or mobile home on a foundation must be owned or under contract and the owner must have lived there for at least seven months during the preceding year.

4219401 PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. Land Value Property Tax Assistance. Montana Disabled Veteran Assistance.

Dont Miss Your Chance. That funding will help Montanan homeowners and homeowners across the country remain in their homes. Among its duties the PAD administers property tax assistance programs.

2019 Income Guidelines for the Property Tax Assistance. Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Land Value Property Tax Assistance Program.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. If you are already approved for the Property Tax Assistance Program you will not need to apply again. The American Rescue Plan Act passed by Congress and signed by the president contains 9961 billion nationwide for a Homeowner Assistance Fund HAF.

If you are already approved for the Property Tax Assistance Program you will not need. 4219401 - PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM. Land Value Property Tax Assistance Program.

The benefit only applies to the first 200000 of value of your primary residence. We last updated the Property Tax Assistance Program PTAP Application in February 2022 so this is the latest version of Form. 4219406 EXTENDED PROPERTY TAX ASSISTANCE PROGRAM EPTAP REPEALED See the Transfer and Repeal Table History.

The Montana Homeowner Assistance Fund will include 50 million in federal funding allocated by Congress. This presentation gives an overview of the role the Montana Department of Revenue DOR through its Property Assessment Division PAD plays in maintaining the property tax record in each county of the state. Click here to learn about property the tax relief programs offered by the State of Montana.

If you have not received a tax statement by November 1 please contact the Treasurers Office at 406-466-2694 and a. We have multiple programs available to help Montana citizens who need assistance with their income or property tax. Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today.

For agricultural and timber parcels the only eligible land is the. Property Tax Assistance Program. You may use this form to apply for the Property Tax Assistance Program PTAP.

View or Pay Property Taxes. The first the Property Tax Assistance Program PTAP reduces residential property taxes for low-income households. Apply by April 15.

Property Tax Assistance Program Application Form PTAP Home Memphis Documents Posts Property Tax Assistance Program Application Form PTAP September 2 2021 by Montana Department of Revenue. This program applies solely to the first 200000 of the primary residences market value. More about the Montana Form PTAP Other TY 2021.

PTAP is designed to assist citizens of Montana who are on a limited or fixed income. 1 The property owner of record or the property owners agent must make application to the local department office to receive the PTAP benefit provided for in 15-6-305 MCA or the MDV benefit provided for in 15-6. To be eligible for the program applicants must meet the requirements of 15-6-302.

Ad 2022 Latest Homeowners Relief Program. Property Tax Assistance Program PTAP will reduce your tax obligation if you meet the following income guidelines. Please let us know how you heard about the Property Tax Assistance Program PTAP.

Property Tax Assistance Programs. The taxpayer must live in their home for at least seven months out of the year and have incomes below 21262 for one eligible owner or below 28349 for a property with two eligible owners. GENERAL PROPERTY TAX PROVISIONS.

Lien Prevention Program.

How Taxes On Property Owned In Another State Work For 2022

Ci 121 Montana S Big Property Tax Initiative Explained

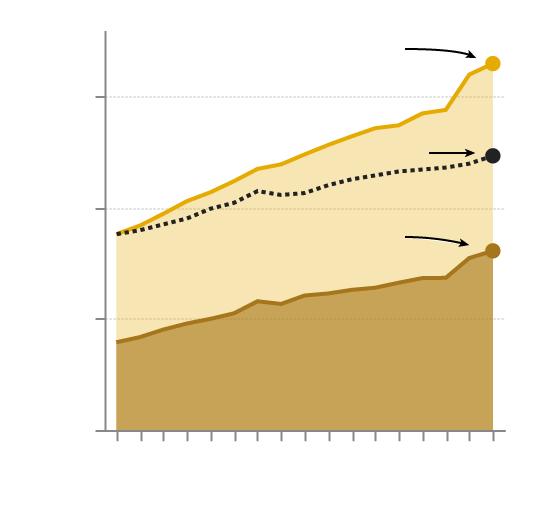

This Chart Explains Saving And Investing In The Simplest Way We Ve Seen Investing Money Where To Invest Investing

The Best States For An Early Retirement Early Retirement Life Insurance Facts Life Insurance For Seniors

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Lawmakers Vote Unanimously To Oppose Property Tax Cap Initiative Montana Public Radio

Did You Receive Your Property Appraisal Notice Here S What It Means And What You Can Do About It Missoula County Blog

Ci 121 Montana S Big Property Tax Initiative Explained

Did Your Property Tax Bill Send You Into Sticker Shock Open Source Richlandsource Com

Boise To Take 3 Increase In Tax Base Here S What That Means For Property Taxes Complete News Coverage Idahopress Com

Property Tax Homestead Exemptions Itep

Tax Breaks For Montana Property Owners Inspect Montana

Tax Relief Programs Montana Department Of Revenue

Montana Lawmakers Vote Unanimously To Oppose Property Tax Cap Initiative Montana Public Radio

Tax Relief Systems Llc Llc Taxes Relief Tax Preparation

Deducting Property Taxes H R Block

Property Tax Help Montana Taxed Right Consulting Llc

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Gallatin County Tax Payment Deadlines Set For June 1 Gallatin County Mt