do instacart take out taxes

Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them. The rate for the 2022 tax year is 625 cents per mile for business use starting from July 1.

Instacart Driver Jobs In Canada What You Need To Know To Get Started

To actually file your Instacart taxes youll need the right tax form.

. Start shopping online now. You can deduct tolls and parking. What Taxes Do Instacart Shoppers Need to Pay.

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. There will be a clear indication of the delivery. Instacarts official name is Instacart other delivery companies use different legal names.

Everyone out there serving for. Instacart 1099 Tax Forms Youll Need to File. Learn the basic of filing your taxes as an independent contractor.

If you had no tax liability at all last year you dont need to make estimated. Answer 1 of 4. Tax tips for Instacart Shoppers.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. If you make more than 600 per tax year theyll send. Do they take out taxes.

Knowing how much to pay is just the first step. Answered September 2 2021 - Personal Grocery Shopper Current Employee - Oroville. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. This tax form summarizes your income for the year deductions and tax. Figuring out how much tax to pay by the 4 deadlines could be a challenge if your income is variable.

Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. Up to 5 cash back Get groceries in as fast as 1 hour with Instacart same-day delivery or pickup in Cliffwood NJ. Your first delivery or pickup order is free.

The rate from January 1 to June 30 2022 is 585 cents per mile. View all 987 questions about Instacart. Instacart Shoppers weve put.

Like all other taxpayers youll need to file Form 1040. Get the scoop on everything you need to know to make tax season a breeze. Everybody who makes income in the US.

Find out the top deductions for Shoppers and more tax tips here. Does Instacart take taxes out of. Instacart delivery starts at 399 for same-day orders over 35.

Asked March 8 2019. The Instacart 1099 tax forms youll need to file. You can find this in your shopper account or keep records in your own bookkeeping app.

No taxes are taken out of your Doordash paycheck.

How Much Do Instacart Shoppers Make 2021 Update Gridwise

Instacart Help Center Authorization Holds Recurring Payments And Unknown Charges

First Time Filling Taxes With Instacart Is It Easy To Do R Instacart

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

Instacart Sued By D C Over Alleged Deception Failure To Pay Taxes

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

What You Need To Know About Instacart Taxes Net Pay Advance

How To Know Your Taxable Income As An Independent Contractor

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

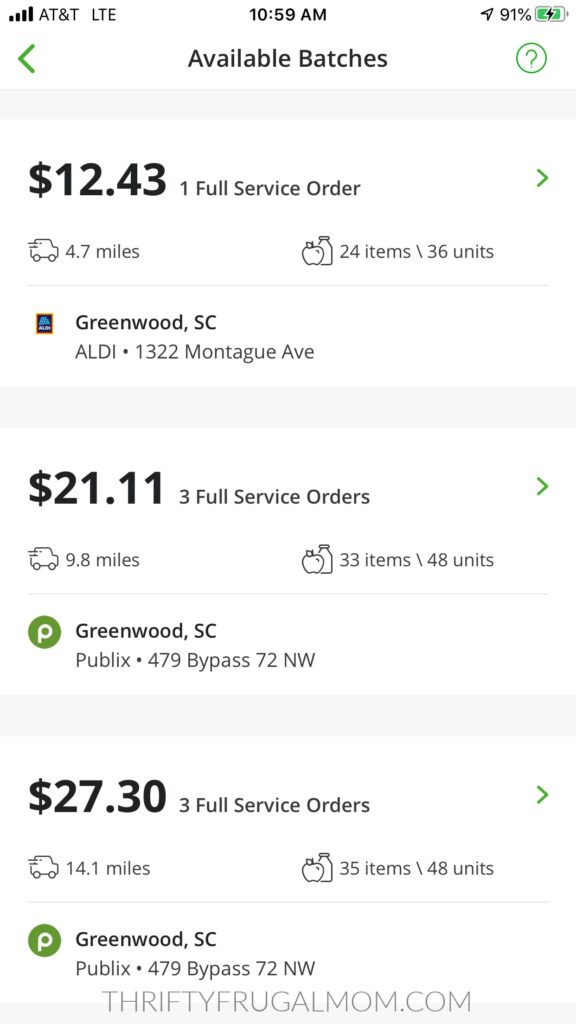

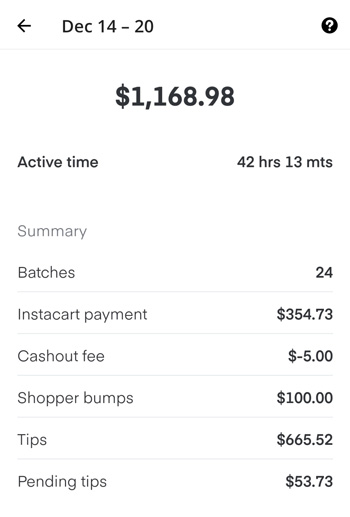

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

When Does Instacart Pay Me A Contracted Employee S Guide

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Instacart Drivers Say This Data Proves They Re Still Being Underpaid

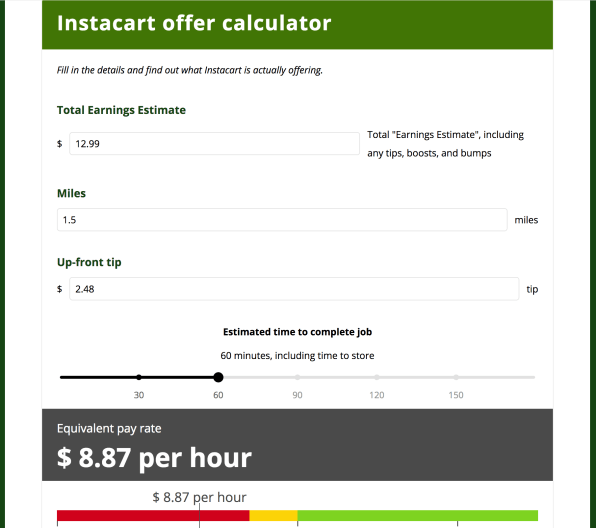

How Much Money Can You Make With Instacart Small Business Trends

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

1099 Taxes For Gig Workers Explained Expert Advice For Independent Contractors 2020 Instacart Youtube

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

How Much Instacart Shoppers Can Expect To Make In 2022 Earnings Statistics Ridesharing Driver