how to calculate pre tax benefits

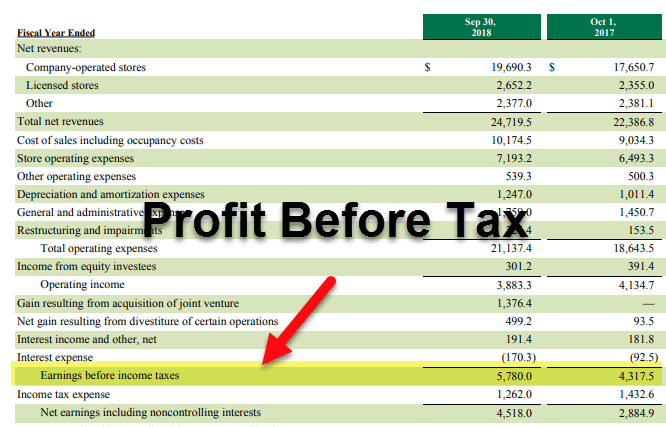

The pre-tax profit margin can be calculated by dividing the EBT by revenue. Pre-tax deductions and post-tax deductions.

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

23000 is 6200 more than 16800.

. Pretax insurance benefits offered under a Section 125 cafeteria plan arent taxable so theyre taken out of your gross wages before taxes are deducted. How much can pre-tax contributions reduce your taxes. Using the formula above the pretax income of Company ABC is calculated as.

Some facts about Saras pretax deductions. Health transportation and retirement. Pre-tax deductions are payments toward benefits that are paid directly from an employees paycheck before withholding money for taxes.

For the given fiscal year FY the pretax earnings margin is 40000 500000 8. A pretax health insurance plan generally includes medical dental and vision coverage for you your spouse and your dependents. The pretax earnings is calculated by subtracting the operating and interest costs from the gross profit that is 100000 60000 40000.

The amount of the savings will vary based on the contribution towards the benefit. Visual of a Pre-tax health benefit account reflecting the 3000 of qualified pre-tax expenses and a corresponding 300 to 1000 in tax savings. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800.

Depending on your tax rate and other factors Lets take a look at three common categories of pre-tax benefits that employers offer. Pre-Tax Margin 25 million 100 million 25. How do I calculate pre-tax.

Pre-tax profits are calculated as follows. Your annual W-2 includes your taxable wages for the year. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and employment taxes are applied.

There are two types of benefits deductions. Based on the above information we can do the calculation of Pretax income using the formula discussed above Pretax Income formula Net Sales- Cost of goods sold-Operating Expenses. If you do not have a cafeteria plan the entire 1200 is subject to Social Security tax.

This amount must be included in the employees wages or reimbursed by the employee. Benefits of Pre-tax Deductions. This reduces the amount of taxable wages that an employee has to pay taxes on.

To determine your total gross wages earned for the year factor in. Identify applicable payroll taxes. How do pre-tax benefits work.

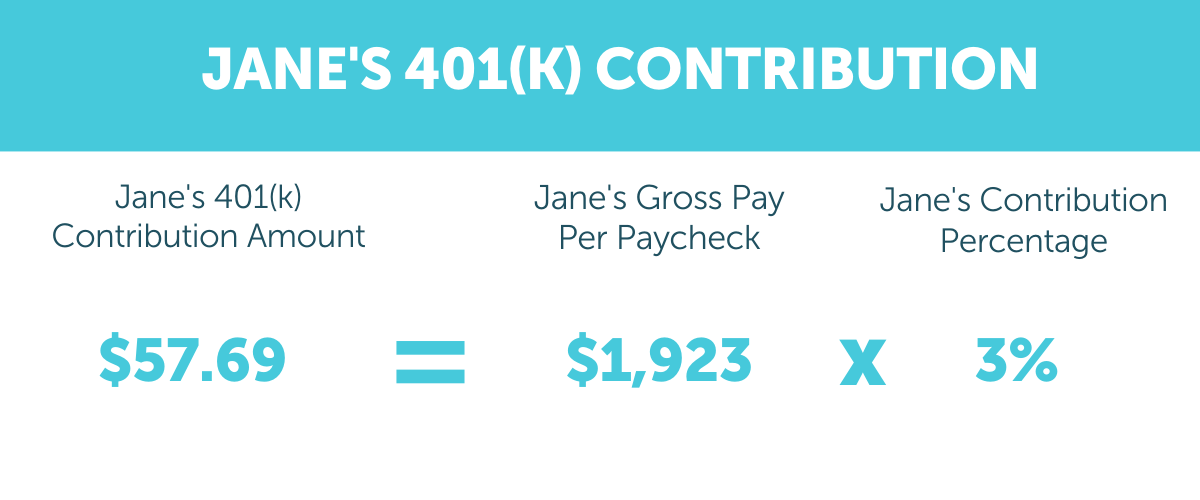

This means a savings of up to 765 on average on payroll taxes. This item shows the income generated by the business from the sale of its goods or rendering the services. Say you have an employee with a pre-tax deduction.

For example it may cover. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. As a result this lowers the total income amount that is taxed which reduces the income taxes the.

By offering employees a pre-tax commuter benefit program the cost of commuting deducted for employees reduces the amount of payroll being taxed. General administrative expenses. In this article well define pre-tax and post-tax.

1000 50 950. Pre-tax deductions reduce the employees taxable income which can save them money when filing their federal income tax. Since your insurance plan isnt taxable your employer does not include your premiums on your W-2.

The allure of a particular job is linked to the type and number of benefits your potential employer offers. This permalink creates a unique url for this online calculator with your saved information. Then find the tax table in the Circular E that goes with your taxable wages pay period and the allowances and filing status stated on the W-4.

Additionally since they are not mandatory the decrease of taxable income comes along with the benefits of your choice. Calculate the taxable wage base for each payroll tax. Pretax Income 8000000 560000 86000 12000 240000 130000 57000 0.

Following are the expenses of the company during the year. The employees taxable income is 950 for the pay period. Identify potential pretax deductions.

Thus Sackett Laboratories made an Earnings Before Tax of 6200 during the year. Formula for Pre-tax Income. Generally speaking pre-tax deductions provide an immediate tax break while post-tax deductions give employees a bigger paycheck.

Pre-Tax Income Revenue Expenses excluding Taxes How to Calculate Pretax Income. Therefore you pay 5040 biweekly in Social Security tax. First subtract the 50 pre-tax withholding from the employees gross pay 1000.

From there the final step before arriving at net income is to multiply the pre-tax income by the 30 tax rate assumption which comes out to 18 million. But the nuances of pre-tax and post-tax benefits can be complicated so its essential to understand how they work before you offer them to your employees. Calculate the employees gross wages.

Earnings from the actual business of the entity are shown here. Pre-Tax Income 30 million 5 million 25 million. Your pre-tax cash flow benefits therefore add up to.

Follow these steps the next time you do payroll. You can use the cents-per-mile rule if either of the following requirements is met. First and of utmost importance is that before-tax deductions in fact reduce taxes.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. For example you earn 1200 biweekly. There are many different types of pre-tax benefits but for the.

Go online and get a copy of IRS Circular E. For 2022 the standard mileage rate is 585 cents per mile. Personal use is any use of the vehicle other than use in your trade or business.

Subtract the value of your debt service from your NOI. Figure federal income tax by retrieving your allowances and filing status respectively from lines 3 and 6 of your W-4 form. With pre-tax benefits you withdraw the amount to cover the cost from an employees paycheck before its taxed.

Your employer may cover some of the cost.

Best 5 Payroll Software System For Businesses Reviano Bookkeeping Business Payroll Software Payroll

If You V Never Considered Using An Hsa For Your Health Insurance Here Are 5 Really Good Reasons Why Yo Health Savings Account Savings Account Money Management

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Are Payroll Deductions For Health Insurance Pre Tax Details More

You To Take After Tax Contributions And Convert Them To Roth Some Employers Even Offer An Auto Convert Feature Insi Retirement Benefits Tax Money Contribution

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

A Visual Guide To Employee Ownership Employee Stock Ownership Plan Business Leadership Journey Mapping

Pre Tax Vs After Tax Medical Premiums

St202 Fundamentals Of Selling A House Calendar Template Print Calendar Desk Calendar Pad

Blog Sisters For Financial Independence Pay Yourself First Personal Financial Advisor Financial Independence Retire Early

Profit Before Tax Formula Examples How To Calculate Pbt

Pauline Nordin Fighter Diet Mind Diet Workout Food

What Are Pre Tax Deductions Bamboohr Glossary

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business